Digital documents are the backbone of modern business, but they also provide fertile ground for sophisticated fraud. Knowing how to detect fake pdf files, recognize altered invoices, and verify receipts is essential for finance teams, auditors, and individual users. This guide explains how fraudsters manipulate PDFs, which technical and visual clues reveal tampering, and which processes and tools reduce risk. Practical, actionable steps are prioritized so organizations can implement stronger defenses immediately.

Understanding PDF Manipulation: How Fraudsters Alter Documents and What to Look For

PDFs can be deceptively easy to edit with readily available software. Fraudsters commonly manipulate numbers, dates, vendor names, bank account details, and line items without changing the overall layout. One frequent technique is overlay editing—placing a new layer or image on top of existing text to change values while preserving the original visual structure. Another is altering metadata and creation timestamps to mask the time and tool used for modifications. At the binary level, embedding or replacing fonts and images can disguise differences that would be obvious in other formats.

Visual inspection alone often misses subtle signs. Look for inconsistent fonts, misaligned table columns, slightly different spacing, or mismatched date formats. Zoom in to detect soft edges where numbers or text may have been pasted. Examine headers and footers for duplicate logos or faint artifacts. For scanned PDFs, inconsistent compression artifacts across pages often reveal pasted or digitally inserted elements. When suspecting tampering, check for multiple layers: many PDF viewers allow toggling layers or viewing content streams to reveal hidden objects.

Technical clues include irregular metadata, mismatched creation and modification dates, and nonstandard producer tags that indicate the editing application. Comparing file hashes against known-good copies is a definitive way to detect changes. If a document was expected to be digitally signed, validate the certificate chain and signature timestamp to ensure integrity. Use detect pdf fraud checks such as verifying embedded signatures or certificate revocation status to uncover altered or forged documents. For day-to-day operations, instituting mandatory digital signatures and preserving original scanned copies helps preserve provenance and simplifies audits.

Tools and Techniques to Verify Authenticity: From Manual Checks to Automated Scanning

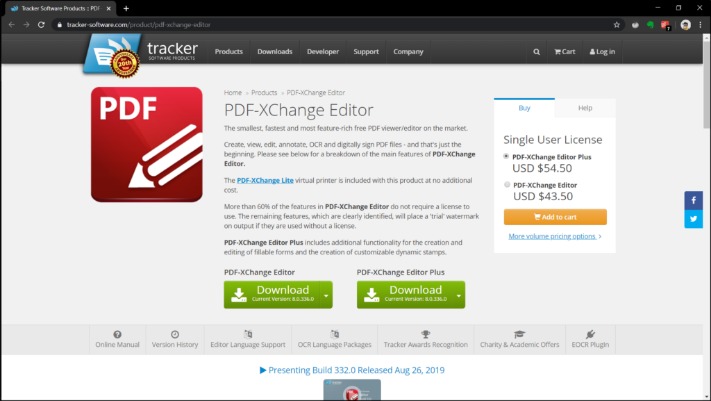

Detecting document fraud requires combining human judgment with specialized tools. Start with basic built-in features: many PDF readers display file properties and metadata, reveal embedded fonts, and show the presence of digital signatures. Use these to spot anomalies quickly. Optical Character Recognition (OCR) can convert image-based PDFs to searchable text, enabling content analysis and keyword searches to detect unusual entries or double-billed line items. Image forensics tools can analyze compression patterns and detect splicing or inconsistent noise levels that suggest edits.

More advanced forensic tools analyze the PDF structure and content streams to find hidden layers, embedded objects, and unusual XObjects that often indicate manipulation. Cryptographic methods—verifying PKI-based digital signatures and checking certificate validity—provide strong non-repudiation when properly implemented. Hashing and checksum comparisons are invaluable when a trusted original exists: any change alters the hash, proving tampering. For organizations, deploying automated scanners that flag anomalies like duplicated invoice numbers, improbable vendor changes, or mismatches between the invoice and purchase order can dramatically reduce risk.

Integrating a reliable verification tool into workflows makes routine checks frictionless. For example, a vendor portal that requires invoices to be uploaded in signed PDF format and runs an automated integrity scan before approval enforces control. When human review is necessary, provide auditors with a checklist: verify sender email, cross-check invoice numbers against purchase orders, validate bank details independently, and confirm signatures. For external validation, consider services that specialize in document verification—tools designed to detect fake invoice can automate checks and provide an audit trail useful in dispute resolution and compliance reporting.

Case Studies and Practical Steps: Real-World Examples and Implementation Strategies

Case Study 1: A mid-size company received a seemingly legitimate invoice from a long-standing supplier with an additional charge for expedited shipping. Visual inspection passed, but a routine integrity scan revealed altered metadata and a newer modification timestamp. The accounts payable team contacted the supplier, who confirmed no such invoice existed. The forged document had been created by overlaying new charges onto an old invoice template. This incident prompted the company to require digitally signed invoices and to route all invoice uploads through automated verification software.

Case Study 2: A travel expense reimbursement scheme involved employees submitting photographed receipts where totals had been subtly increased. Image forensic analysis exposed inconsistent compression artifacts and repeated pixel patterns indicative of cloning. The organization introduced a mobile app that captures receipts with embedded GPS and timestamp metadata and requires employees to submit original merchant receipts for higher-value claims. These process controls reduced fraudulent reimbursements by creating stronger links between the expense and the source transaction.

Practical implementation steps for organizations include establishing clear document-handling policies: require original signed PDFs for vendor payments, mandate two-person approval for high-value invoices, and maintain secure, versioned storage with immutable logs. Train staff to recognize social engineering attempts that accompany fake documents, such as urgent payment requests and spoofed email addresses. Automate as much as possible: deploy software that validates digital signatures, checks metadata, compares document hashes, and cross-references invoice data with procurement systems. Finally, document every verification and rejection decision to build an audit trail that deters repeat offenders and supports recovery if fraud occurs.