Understanding how interest compounds and how payments are applied can transform a frustrating credit card balance into a manageable plan. A credit card calculator is a practical tool that breaks down complex amortization math into clear monthly figures, showing how different payment strategies affect total interest paid and payoff time. Whether the goal is to escape a revolving balance, optimize a payment schedule, or compare card offers, a reliable calculator provides the data needed to make informed choices. The following sections explain how these calculators work, strategies to lower interest costs, and real-world examples that demonstrate the tangible benefits of using precise calculations when tackling credit card debt.

How a Credit Card Calculator Works and Why It Matters

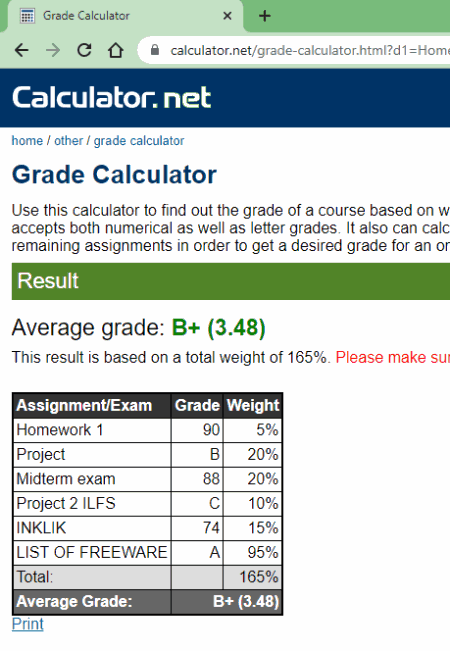

A credit card calculator converts a few simple inputs—current balance, annual percentage rate (APR), and monthly payment—into actionable outputs like months to pay off the balance and total interest paid. The engine behind the calculator typically applies daily or monthly interest accrual models depending on the card’s terms. With a monthly interest approach, the APR is divided by 12 to get a monthly rate; balances are multiplied by that rate to compute interest, then payments subtract interest first and reduce principal. This process repeats month by month to build a full amortization schedule.

Understanding the mechanics matters because many cardholders only focus on the minimum payment, which often covers mostly interest and barely reduces principal. A calculator highlights how paying slightly more than the minimum can dramatically shorten payoff time and reduce interest. It also reveals the hidden cost of high APRs: two cards with similar balances can end up costing vastly different amounts over time. For consumers comparing balance transfer offers or promotional APRs, the calculator helps weigh transfer fees against potential interest savings, showing if a promotional period will actually yield net benefit.

Advanced calculators include features like extra monthly payments, one-time lump-sum payments, changing APRs, and penalty APR scenarios, allowing users to model realistic situations. The clarity these tools provide turns abstract percentages into concrete monthly results, empowering users to set targets, track progress, and make evidence-based decisions about which debts to prioritize and how to allocate extra cash for maximum savings.

Strategies to Reduce Interest and Pay Off Balances Faster

Small changes in payment behavior can lead to outsized savings. One effective strategy is to pay more than the minimum each month. Even a modest increase—5% or 10% above the minimum—can shave months off the payoff timeline and reduce interest significantly. Another approach is the debt avalanche method, which focuses extra payments on the highest APR balance first; this minimizes total interest paid. Alternatively, the debt snowball method targets the smallest balance to build momentum and psychological wins, which can improve adherence to a repayment plan.

Using a calculator to simulate these strategies helps select the best option for both emotional and financial payoff. For example, modeling an avalanche versus snowball approach with the same total monthly payment will show which saves more interest and which pays off sooner. Balance transfers to a 0% introductory APR card are another tactic: moving a balance can produce large interest savings during the promo period, but calculators are essential to factor in transfer fees and the length of the promotional term to determine if the move is worthwhile.

Refinancing or consolidating credit card debt with a personal loan can also lower monthly costs by converting variable APRs into a fixed-rate installment loan with structured payments. When considering this, use the calculator to compare current credit card projections to the proposed loan schedule. Finally, automatic payment increases timed with pay raises, applying windfalls to principal, and avoiding new revolving charges will keep the downward momentum. Regularly revisiting calculations ensures the plan adapts to changing rates, incomes, and balances.

Real-World Examples and Case Studies That Turn Numbers into Action

Case studies illustrate the power of applying a calculated plan. Consider a cardholder with a $7,500 balance at 19.99% APR making only the 2% minimum payment. A simple calculation shows this scenario could take many years to clear and result in thousands paid in interest. By contrast, raising the monthly payment to a set $200 reduces payoff time dramatically and trims total interest by a large margin. Another example involves a balance transfer: a consumer moves $5,000 to a card with a 12-month 0% APR and a 3% transfer fee. Plugging the fee and promotional period into a calculator clarifies whether the transfer fee is offset by interest saved during the promo term and whether remaining balances will incur higher APRs afterward.

Small business owners with company cards also benefit from modeled scenarios. For instance, separating personal from business expenses, forecasting cash flow, and timing larger payments during months with higher receivables prevents interest accumulation and preserves liquidity. In employer-sponsored financial wellness programs, employees who use a calculator to simulate aggressive payoff schedules often choose higher fixed payments that achieve debt-free status faster and free up future income for savings or investments.

For hands-on testing, try a dedicated tool like credit card calculator to input multiple scenarios—changing APRs, payment sizes, and extra lump-sum payments—to visualize outcomes. Seeing month-by-month amortization builds confidence and creates a roadmap that turns intention into measurable progress, making the journey from revolving debt to financial flexibility both realistic and attainable.